Understanding Water Damage Coverage: A Comprehensive Guide for Texas Homeowners

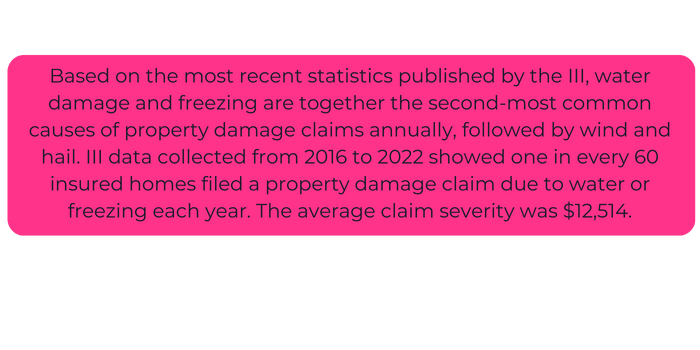

Water damage is a significant concern for Texas homeowners, ranking as the second most common reason for property insurance claims, just after hail damage. With claims averaging $12,514, understanding water damage coverage nuances is vital when selecting a homeowners insurance policy. In this comprehensive guide, we’ll explore the types of water damage covered, the importance of checking your policy, essential coverage considerations, and the invaluable role of an insurance advisor in guiding you through the process.

Coverage for Sudden and Accidental Discharge:

Standard homeowners insurance policies in Texas typically include coverage for sudden and accidental discharge of water or steam within your home. This encompasses scenarios such as burst pipes from your water heater or malfunctions in appliances like refrigerators and washing machines. Additionally, damage caused by firefighting efforts is generally included in this coverage. The critical criterion for this coverage is that the damage occurs unexpectedly, leading to interior damage in your home.

It’s essential to remain vigilant, as some agents may remove or drastically lower the coverage for sudden and accidental water damage to win business based solely on price. This underscores the importance of thoroughly reviewing your policy and consulting with an insurance advisor to ensure you’re adequately protected against water-related risks.

Storm-Related Water Damage:

Texas homeowners insurance policies also typically include coverage for water damage resulting from storms. For example, if a fallen tree or debris during high winds compromises your roof or walls, any ensuing water damage is typically covered.

Wind-Driven Rain Coverage:

For homeowners with an open peril (HO-3) policy, Wind-Driven Rain coverage becomes a crucial consideration. During windstorms, rain can infiltrate your home through various entry points such as shingles, drip edges, or roof vents. If the water damage is solely a result of wind-driven rain without accompanying debris damage, this coverage becomes vital. It’s important to note that this coverage may not be provided under a named peril policy. Given the frequency of storms in Texas, homeowners should prioritize this coverage option.

*It’s important to note that if your home is in one of Texas’ 14 coastal counties, you may have a separate Windstorm insurance policy that covers storm-related water damage and wind-driven rain coverage. (Aransas, Brazoria, Calhoun, Cameron, Chambers, Galveston, Jefferson, Kenedy, Kleberg, Matagorda, Nueces, Refugio, San Patricio, Willacy, and parts of Harris)

Types of Water Damage Not Covered:

Understanding what’s not covered by your homeowners insurance policy is equally important. Flood damage, lack of maintenance or negligence, earth movement, intentional acts, and certain types of water damage from sump pump failure or sewer backup may not be covered without additional optional coverage.

The Importance of Having an Insurance Advisor:

Navigating the complexities of homeowners insurance policies, especially when it comes to water damage coverage, can be daunting. An insurance advisor plays a crucial role in guiding you through the process, helping you understand your coverage options, assessing your needs, and finding the best policy to protect your home and assets.

Conclusion:

Water damage can wreak havoc on your home and finances, making comprehensive insurance coverage essential for Texas homeowners. By understanding the nuances of water damage coverage, reviewing your policy, considering optional enhancements, and seeking guidance from an insurance advisor, you can ensure that your home is adequately protected against unforeseen events. Take proactive steps today to safeguard your Texas home and enjoy peace of mind, knowing you’re prepared for any water-related challenges that may arise.

Last but not least, our agency was established in 2005, and we’ve never seen anything like this crazy insurance market before. To help, we started a LOCAL FACEBOOK GROUP to give our clients and community tips on how to get the best value on their insurance during this crazy market.

FYI – The group is a marketing-free zone! It’s only to help navigate renewals, claims, answer questions, and provide value.

Please join today and check out the Featured posts, use the search bar, or ask any questions you have. https://bit.ly/GreaterHoustonInsurance

Caroline Johnson, SBCS

Vice-President

by Sparrow Websites

by Sparrow Websites